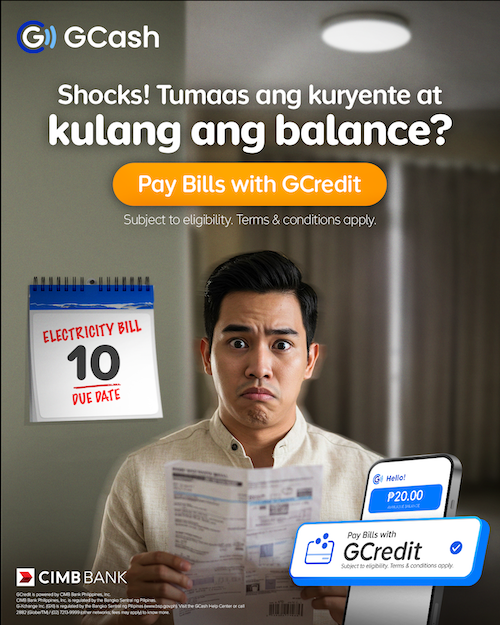

Electricity, water, internet, groceries—every day, it feels like there’s always something new to pay for. Now that the school year is in full swing, daily allowances and baon have also become part of the routine. And just when we think we’ve caught up, surprise gastos show up—plus the holidays creeping in make budgeting feel endless.

No matter how carefully we plan, sometimes our budget just isn’t enough. During petsa de peligro, a little help goes a long way—and with GCash, you don’t need a credit card or to borrow from family and friends.

That’s where GCredit, powered by CIMB, comes in. It’s a ready credit line built right into your GCash app, designed to cover urgent needs with ease. With a low daily interest rate of just 0.17% (₱1.70 per ₱1,000 spent) and flexible payment terms where you can settle as little as 10% of your total due, GCredit helps you manage expenses while waiting for your next paycheck, bonus, or allowance.

Where GCredit Can Help You

-

Bills: Avoid late fees and disconnections by covering electricity and water bills even when payday doesn’t align with due dates.

-

Internet & Landline: Stay connected with family, friends, school, and work by using GCredit to cover urgent payments.

-

Groceries: Stretch your budget and shop for essentials without having to cut back on meals.

Why GCredit Makes Sense

-

Low interest: Only 0.17% per day—and the earlier you pay, the less interest you owe.

-

Flexible payments: Pay at least 10% of your total due to stay on track.

-

Credit line up to ₱50,000: Accessible instantly from your GCash app.

How to Get Started

To check eligibility, open your GCash app, tap “Borrow” on the home screen, and select “GCredit.” If you qualify, simply:

-

Confirm your email address.

-

Verify your personal details.

-

Review and submit your application.

Once approved, you’ll receive an SMS and email confirmation—then you’re ready to use GCredit for your everyday needs. Just remember to use it responsibly and always plan your payments.

Whether it’s rising bills, school expenses, or last-minute holiday spending, you don’t have to stress. With GCredit, you’ve got a fast, flexible, and reliable safety net for life’s daily expenses.