Credit often gets a bad rap. For some, it’s a safety net. For others, it feels like a trap. But the truth is, when managed with intention, credit isn’t just debt. It can be one of the strongest tools you have for financial growth. The key lies in how it’s built and who it’s built for.

That’s where Maya, the #1 Digital Bank in the Philippines, makes a difference. Instead of offering one-size-fits-all products, Maya creates credit solutions that adapt to your needs, whether you’re navigating emergencies, covering everyday essentials, or reaching for bigger goals.

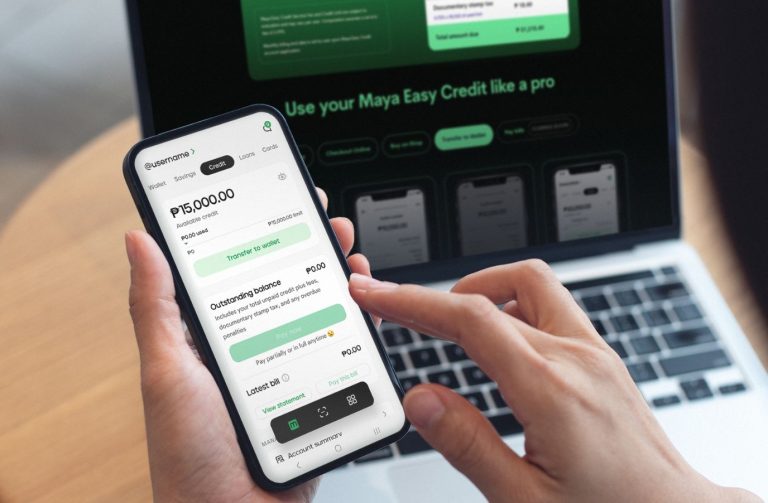

With Maya Easy Credit, you get instant access to a revolving credit line of up to Php30,000, no paperwork required and up to 30 days to repay what you use. It’s built right into the Maya app, so you can borrow and manage your money in one seamless place.

When you need more than a quick boost, Maya Personal Loan lets you borrow up to Php250,000 with flexible repayment terms of up to 24 months. No collateral, no hidden catches. Just clear and predictable payments that make large expenses or debt consolidation easier to handle.

For everyday spending, Maya also offers credit cards that go beyond convenience. The Landers Cashback Everywhere Credit Card gives you up to 5% back at Landers, 2% on dining, and 1% on other qualified purchases. And for a more elevated option, the Maya Black Credit Card turns every swipe into Maya Miles, points you can use for shopping, dining, or even convert into airline miles with partners like Philippine Airlines, all managed within the app.

Maya also helps you balance borrowing with saving. Through Personal Goals, you can set up to five savings targets, each earning 4% p.a. interest, so you’re always building buffers for things like tuition, travel, or unexpected expenses.

Responsible borrowing doesn’t mean saying no to credit. It means choosing tools that fit your life, give you control, and help you grow. With Maya, you get transparency, flexibility, and respect for your financial journey. Credit that works with you, not against you.